Cryptocurrency

At the end of June 2022, the Council presidency and the European Parliament reached a provisional agreement on the markets in crypto assets (MiCA) proposal which covers issuers of unbacked crypto assets, and stablecoins, as well as the trading venues and wallets where crypto assets are held. https://elmergernaleartworks.com/ This regulatory framework is intended to protect investors and preserve financial stability while allowing innovation and fostering the attractiveness of the crypto asset sector. The purpose of MiCA is to provide more clarity across the European Union, as some member states already have varying national legislation for crypto assets, but there had been no specific regulatory framework at an EU level.

Generally speaking, the Chinese government has illustrated a positive attitude towards blockchain technology. But though it will be an essential part of the future, blockchain technology is still in its early stages of development. Working in the industry feels like walking on a path where the first sunlight is about to dawn. Even though our destination is unknown, I am excited about where it could lead. Blockchain deserves an infinite and imaginative future.

The One Belt One Road initiative could allow China to control the artery of trade in global emerging markets, where most growth will take place in the coming decades. If the PBOC issues its own cryptocurrency and uses it to replace the dollar for trade along the belt and road, it could challenge the dollar’s dominance and offer optionality to these countries. A considerable portion of the belt and road trade and investments are being carried out by Chinese state-owned enterprises with a political mandate. This could make the implementation of a PBOC-backed cryptocurrency more efficient. Such a digitally controlled approach could allow China to strike a balance between capital control and RMB internationalization that wasn’t possible before.

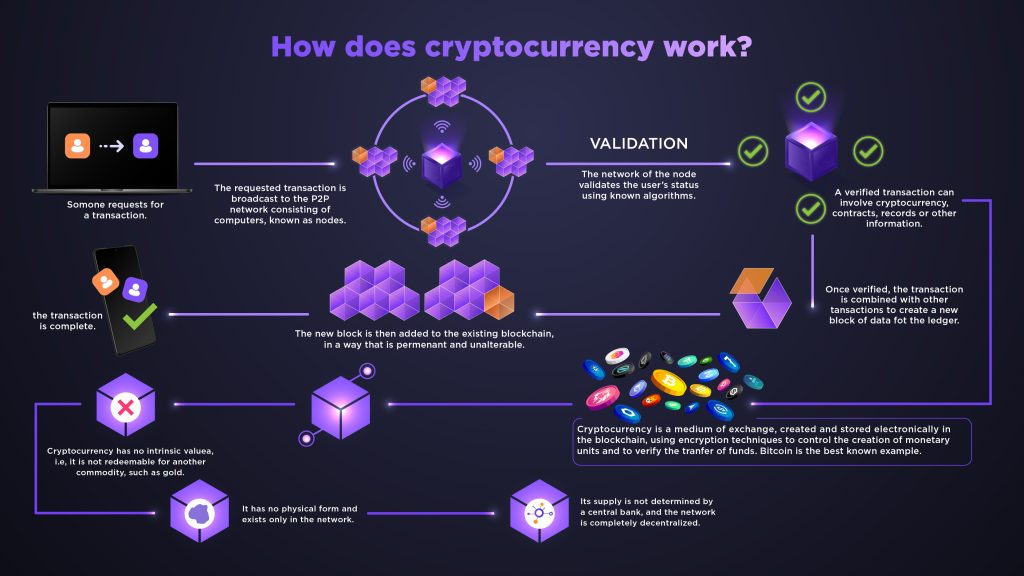

How does cryptocurrency work

George owes $10 to both Michael and Jackson. Unfortunately, George only has $10 in his account. He decides to try to send $10 to Michael and $10 to Jackson at the same time. The bank’s staff notice that George is trying to send money that he doesn’t have. They stop the transaction from happening.

However, the sums are becoming more and more difficult as more Bitcoins enter circulation – a fancy way of saying there are more coins up for grabs – to make sure there aren’t too many being generated. To put it in context, if you were to start mining now, it could be years before you got a single Bitcoin!

In 2008, a group of people (currently known under the pseudonym Satoshi Nakamoto) created the guiding principles of the first and leading cryptocurrency in the market today, Bitcoin. In 2009, Bitcoin was launched to the world. But it would be years before it was formally recognized as a means of payment among leading merchants, starting with WordPress in 2012.

What is cryptocurrency mining? People who are running software and hardware aimed at confirming transactions to the digital ledger are cryptocurrency miners. Solving cryptographic puzzles (via software) to add transactions to the ledger (the blockchain) in the hope of getting coins as a reward is cryptocurrency mining.

TIP: Like anything else in life, there are tax implications to trading or using cryptocurrency. Make sure you understand the tax implications. In short, you’ll owe money on profits (capital gains) and may owe sales tax or other taxes when applicable. Learn more about cryptocurrency and taxes.

Top 10 cryptocurrencies

Nevertheless, Australians are crypto-curious. According to consumer group CHOICE, almost one in five Aussies are either involved in some form of cryptocurrency trading or are interested in getting involved. Those who steer clear from crypto often do so because of the risk of crypto scams. Some 4.6 million Australians own cryptocurrency, and Australia ranks third in the world for crypto uptake.

For astute investors, crypto assets can be an interesting addition to a diversified portfolio. However, they require careful research, strong security practices and a strong stomach to weather the volatility they bring. The Australian Government is yet to introduce legislation to Parliament to regulate crypto markets, and until they do, it will remain a haven for scammers.

Finding the perfect crypto wallet can be a bit tricky, as the best one for you will depend on your specific needs and preferences. Crypto wallets come in different types, such as hardware and software wallets, each with its own pros and cons. Don’t forget to consider factors like security, ease of use, and compatibility with various cryptocurrencies when selecting a wallet. To help you make an informed decision, we recommend reading our crypto wallet review of the Best Crypto Wallets for Australians.

A cryptocurrency is a digital asset that can circulate without the centralised authority of a bank or government. According to CoinMarketCap, there are more than two million cryptocurrency projects out there that represent the entire $US2.23 trillion crypto market.

Somewhat later to the crypto scene, Cardano (ADA) is notable for its early embrace of proof-of-stake validation. This method expedites transaction time and decreases energy usage and environmental impact by removing the competitive, problem-solving aspect of transaction verification in platforms like bitcoin. Cardano also works like Ethereum to enable smart contracts and decentralised applications, which ADA, its native coin, powers.

TON’s unique features, such as ultra-fast transactions, low fees, apps ecosystem, and Telegram integration, have rocketed the coin into the top 10 cryptocurrencies by market capitalisation over the past few months. As of September 24, 2024, its price stands at $5.59, representing an increase of 1,018% from the coin’s ICO price of $0.50 in 2019.