To complete, this method involves transfer of funds from revenue-generating accounts such as wages payable and interest receivable to an intermediary account known as income summary. Therefore, we can calculate either profit margin for this company or how much it lost over the year. Notice that revenues, expenses, dividends, and income summaryall have zero balances. The post-closing T-accounts will be transferred to thepost-closing trial balance, which is step 9 in the accountingcycle.

Balancing the Books: Numeric’s Month End Close Primer

Closing the books not only helps to ensure the accuracy and completeness of the financial statements but also provides a clean set of books for the next accounting period. It’s important to carefully follow each step of the closing process in order to properly close the books at the end of an accounting period. Now that we have closed income and expenses, we need to move the balances from the income summary to retained earnings.

Closing Entry – FAQs

The income summary account is only used in closing process accounting. Basically, the income summary account is the amount of your revenues minus expenses. You will close the income summary account after you to change without transfer the amount into the retained earnings account, which is a permanent account. Transferring funds from temporary to permanent accounts also updates your small business retained earnings account.

Do you already work with a financial advisor?

A company will see its revenue andexpense accounts set back to zero, but its assets and liabilitieswill maintain a balance. In summary, the accountant resets thetemporary accounts to zero by transferring the balances topermanent accounts. The balance in dividends, revenues and expenses would all be zero leaving only the permanent accounts for a post closing trial balance.

Monthly Financial Reporting Template for CFOs

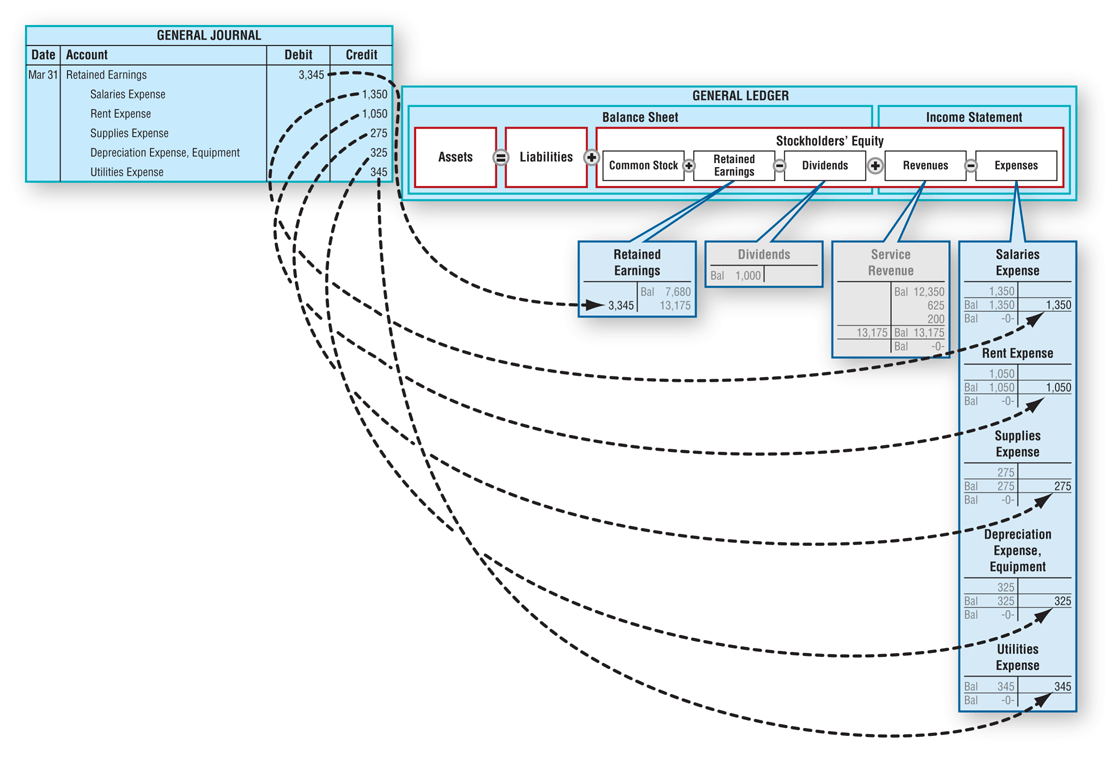

The accounting cycle involves several steps to manage and report financial data, starting with recording transactions and ending with preparing financial statements. These entries transfer balances from temporary accounts—such as revenues, expenses, and dividends—into permanent accounts like retained earnings. A closing entry is a journal entry made at the end of an accounting period to transfer the balances of temporary accounts (like revenues, expenses, and dividends) to the permanent accounts (like retained earnings).

Now for this step, we need to get the balance of the Income Summary account. In step 1, we credited it for $9,850 and debited it in step 2 for $8,790. Bank reconciliation, or cash account recs, at month-end typically involves matching the bank statement with the company’s general ledger account balance, identifying discrepancies and making necessary adjustments. And considering that the month-end looks different for every single company out there, you’re almost better off asking accountants what isn’t included in the month end close process than what is. Lastly, you’ll repeat the process for each temporary account that you have to close.

- Since dividend and withdrawal accounts are not income statement accounts, they do not typically use the income summary account.

- Instead, as a form of distribution of a firm’s accumulated earnings, dividends are treated as a distribution of equity of the business.

- When moving towards a more sophisticated close process, often teams start reconciling the accounts that are most important for their businesses and then expand over time.

- This process resets the balances of the temporary accounts to zero, preparing them for the next accounting period and accurately reflecting the financial performance and position of the company.

The month-end close is a structured process that companies use to wrap up their financial activities by the end of each month. It’s a way to close the books and provide an up-to-date picture of the company’s financial performance from the previous month to inform decisions for the next month. Temporary accounts will have a zero balance after closing entries are made.

A closing entry is a journal entry made at the end of an accounting period. It involves shifting data from temporary accounts on the income statement to permanent accounts on the balance sheet. These accounts must be closed at the end of the accounting year. Closing entries are entries used to shift balances from temporary to permanent accounts at the end of an accounting period. These journal entries condense your accounts so you can determine your retained earnings, or the amount your business has after paying expenses and dividends.

As a result, the temporary accounts will begin the following accounting year with zero balances. Remember, dividends are a contra stockholders’ equity account.It is contra to retained earnings. The remaining balance in Retained Earnings is$4,565 (Figure5.6). This is the same figure found on the statement ofretained earnings. The fourth entry requires Dividends to close to the RetainedEarnings account.

You can find this by taking a look at the trial balance or income statement in your accounting system. Once you have completed and posted all closing entries, the final step is to print a post-closing trial balance, and review it to ensure that all entries were made correctly. Notice that the balances in interest revenue and service revenueare now zero and are ready to accumulate revenues in the nextperiod. The Income Summary account has a credit balance of $10,240(the revenue sum). The eighth step in the accounting cycle is preparing closingentries, which includes journalizing and posting the entries to theledger.